abolishment of gst malaysia

Judging from the data GST collection was RM44 billion a year and the total during its implementation was RM1331 billion while SST collection was just RM21 billion annually he said when winding up the debate on the Sales Tax Amendment. Abolishment of GST affected countrys revenue Abd Rahim.

An Introduction To Malaysian Gst Asean Business News

After the 2018 election the newly elected Prime Minister Mahathir Mohamad intention to scrap a six per cent Goods and Services Tax GST within 100 days has economists and budget analysts on edge about the ripple effects.

. He said this was because the country faced. The Malaysian people widely. The GST was introduced in 2015 before the then government decided to abolish the tax system in 2018.

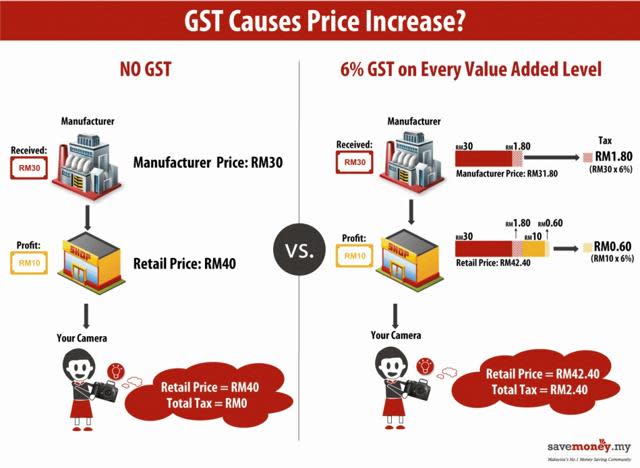

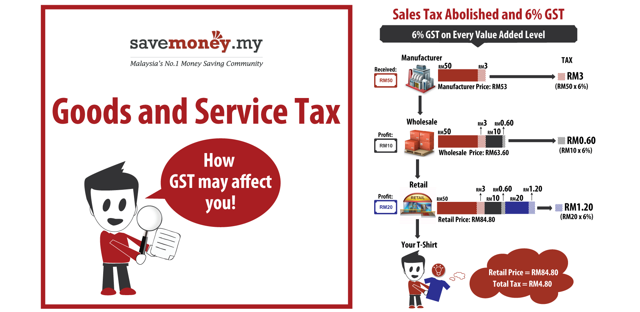

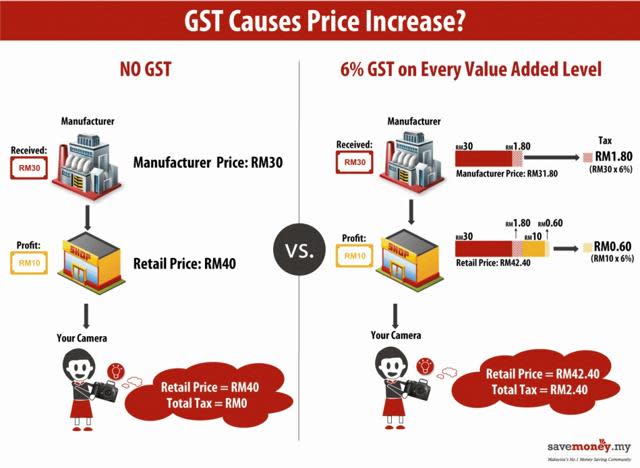

Malaysias national debt stands at over RM644 billion which is 6785 of gross domestic product GDP. THE argument that the Goods and Services Tax GST was a major factor in price increases found receptive ears among Malaysians. When GST was abolished by the Pakatan Harapan PH government it was a political decision based on an election promise that was not based on sound economic principles.

GST To Be Abolished. KUALA LUMPUR May 14 Reuters - Malaysia has not yet set a date for the abolishment of the Goods and Services tax GST the finance ministry said. The unpopular consumption tax was abolished just over three years after its implementation in April 2015.

Finally GST is dead. Abolishing GST will force the new government to find new ways to make up for the loss in. By MT Webmaster On Dec 29 2020.

Written by Jasmine Andria. For the first time since 1957 the ruling partys political power was handed over to the opposition coalition Pakatan Harapan PH by the 14th general election held on 9 May 2018. He said the GST which was implemented in 2015 will be replaced with the Sales and Services Tax.

Goods and Services Tax GST was implemented on 1 April 2015 at a standard rate of 6. He said this was because the country faced a revenue shortfall when the GST was abolished and replaced with the sales and service tax SST. Pakatan Harapan will keep its promise to abolish the Goods and Services Tax GST after forming the Federal government.

Lets take a look at the numbers. 10 May 2018 represented a truly significant landmark in the history of Malaysia as the general elections resulted in a change in the Federal Government for the first time. Prime Minister Tun Dr Mahathir Mohamad promised to abolish the Good and Services Tax GST after they formed the federal government.

Bernama The previous governments decision to abolish the Goods and Services Tax GST has to some extent affected the countrys revenue said Deputy Finance Minister I Datuk Abd Rahim Bakri. The PH manifesto stated that abolitions main objective is to put more purchasing power in the hands of the people particularly those who earn lower or middle incomes. Time would tell whether or not the transition to SST is a bright move for us as a nation.

The GST was also highly politicised abolishing it was the numero uno promise of the Pakatan Harapan government in its election manifesto on the. The implementation of the Goods and Services Tax GST on April 1 2015 and its abolishment three years later probably makes it one of the most if not the most controversial tax to be introduced in Malaysias history. The Goods and Services Tax GST implementation in Malaysia had raised various responses from many parties involved when the new tax was introduced in 2015 until its abolishment in 2018.

Economy GST News Updates. The promise to abolish GST was a powerful card played successfully by then opposition Pakatan Harapan to wrest power from Barisan Nasional. GST complexity has been stated as part of the reasons for its resistance and abolishment.

The GST was also highly politicised abolishing it was the numero uno promise of the Pakatan Harapan government in its election manifesto on the. Malaysia announced the abolishment of its Goods and Services Tax GST effective from 1 June 2018. Abolishment of GST in Malaysia.

GST was introduced to help curb the debt problem. Speaking in Parliament Finance Minister Lim Guan Eng said. The PH manifesto stated that the main objective of the abolition was to put more purchasing power in the hands of the Rakyat particularly the lower to middle income earners.

May 16 2018 801 PM SGT. A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the. The implementation of the Goods and Services Tax GST on April 1 2015 and its abolishment three years later probably makes it one of the most if not the most controversial tax to be introduced in Malaysias history.

However three years later in May Malaysias Ministry of Finance announced that GST would be abolished and replaced by SST. Its impact would indeed be felt over the long-term mainly in terms of costs of living and the strength of our Ringgit. The transition from GST to SST in Malaysia has its given and takes.

Abolishing GST reintroducing SST. KUALA LUMPUR The previous governments decision to abolish the goods and services tax GST had to some extent affected the countrys revenue said Deputy Finance Minister I Datuk Abd Rahim Bakri. When GST was first introduced on 1 April 2015 at a rate of 6 it was used to resolve the countrys low inflation rate and weaknesses in.

Pakatan Harapan the coalition forming the new Government had run the election on a comprehensive reform agenda which included as a cornerstone policy the abolition of the unpopular goods and services tax. KUALA LUMPUR - Malaysias goods and services tax GST will be reduced from 6 per cent to zero per cent from June 1 the Finance Ministry said on Wednesday May 16. The purpose of this paper is to identify causes of GST complexities during its.

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

A Guide To Gst In Malaysia How Does It Affect Me

What India Can Learn From Failure Of Malaysia S Gst Mint

A Guide To Gst In Malaysia Goods And Services Tax

Compulsory Registration For Gst Turnover Above Threshold Of Rm500 000 Download Scientific Diagram

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

A Guide To Gst In Malaysia How Does It Affect Me

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

A Guide To Gst In Malaysia How Does It Affect Me

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Compulsory Registration For Gst Turnover Above Threshold Of Rm500 000 Download Scientific Diagram

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Gst Better Than Sst Say Experts

Gst In Malaysia Will It Return After Being Abolished In 2018

Gst Will Be Improved If It Is Reintroduced Says Tengku Zafrul The Edge Markets

Gst Not A Magic Bullet Says Tax Expert Malaysianow

Was Ph Right To Abolish Gst The Edge Markets

Tengku Zafrul Govt Still Studying All Tax System Including Gst Topcarnews

No comments for "abolishment of gst malaysia"

Post a Comment